The Best Cities for Buying a House as a Single Woman

Intro

The real estate market is ever-changing. Trends in renting versus buying, apartments versus condos, and downtown versus suburban settings are evolving over time. But perhaps one of the most exciting new trends is the rise in single women’s homeownership.

With more financial autonomy and social independence than ever before, women are buying homes that they can live in or rent out to others. What’s more, single women certainly took advantage of lower mortgage rates during the pandemic. According to the Guardian, single women bought 8.7% more homes in Q4 of 2020 than in the fourth quarter of the previous year.

With these shifts in the real estate landscape, DeedClaim wanted to dive deeper into the topic. We know that single, female house hunters must consider city factors like community, affordability, and safety in addition to opportunities for employment, dating, and socialization, so we analyzed 50 major cities around the U.S. against this set of home-buying criteria in order to find the best cities for single lady homeownership.

Read on to see where your city lands!

Results

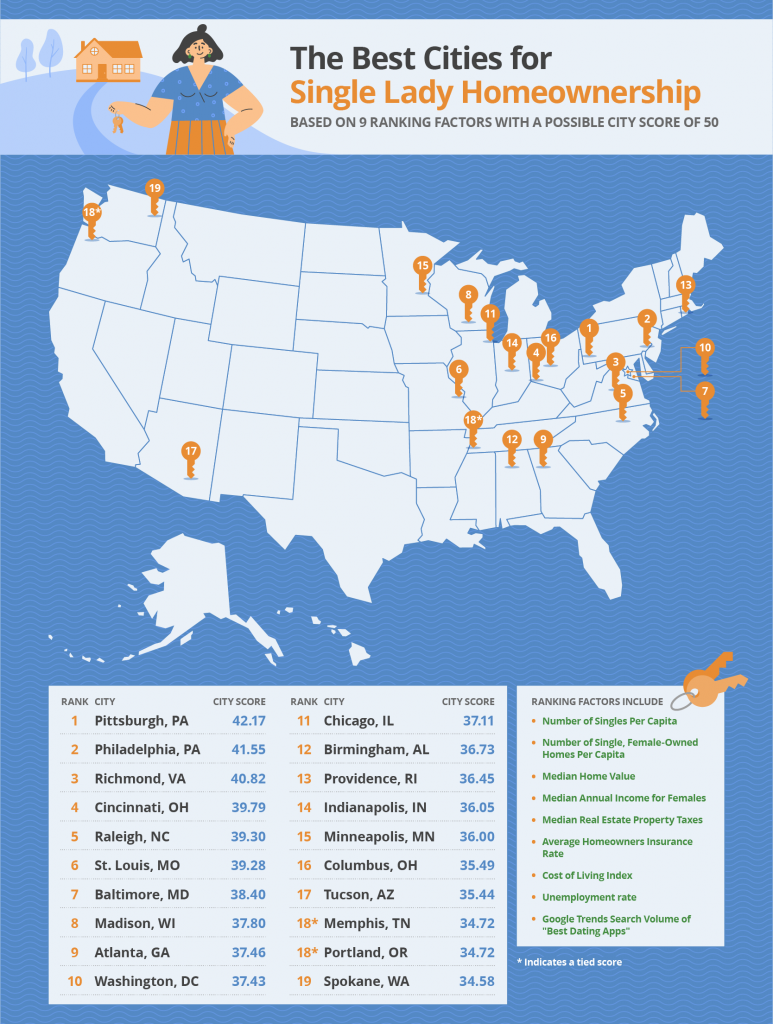

First, we mapped out the top 20 cities for single lady homeownership. The top city, Pittsburgh, PA scored an impressive 42.17 out of 50 points. The markedly high score stems from Pittsburgh’s high number of female-owned homes and a surprisingly low median home price of $138,000. This means that women in Pittsburgh can enter a buyer’s market with lower home costs and a city full of single lady homeowners to seek advice from.

The top cities that followed were all very close neighbors of Steeler city. Philadelphia, Richmond, and Cincinnati were the next best cities for single lady homeownership. Of these three cities, Philadelphia had a notably high median female income of $51,343. Richmond and Cincinnati had similar patterns to Pittsburgh in terms of female homeownership and low home value.

Interestingly, a high concentration of mid-Atlantic and midwestern cities earned top spots in the city rankings. On the other hand, many Southern and Western cities did not make the top of the list, though Portland, OR, Spokane, WA, and Atlanta, GA all squeezed into the top 20.

The table below shows which combination of high-scoring factors earned the top six cities for single lady homeownership their place in the rankings.

Notably, none of the top six cities for single lady homeowners score particularly high for a presence of low insurance rates, meaning that even in the best cities, single female homeowners will still have to balance their budgets to write those insurance checks.

Similarly, in Pittsburgh, Richmond, Cincinnati, and St. Louis, female income scores all hovered around two out of five possible points. Even in cities like these where women have been able to purchase homes, low median incomes potentially hold back a wider demographic of female buyers. Perhaps as median female income increases in high-growth areas, even more women will be financially empowered to purchase their own homes.

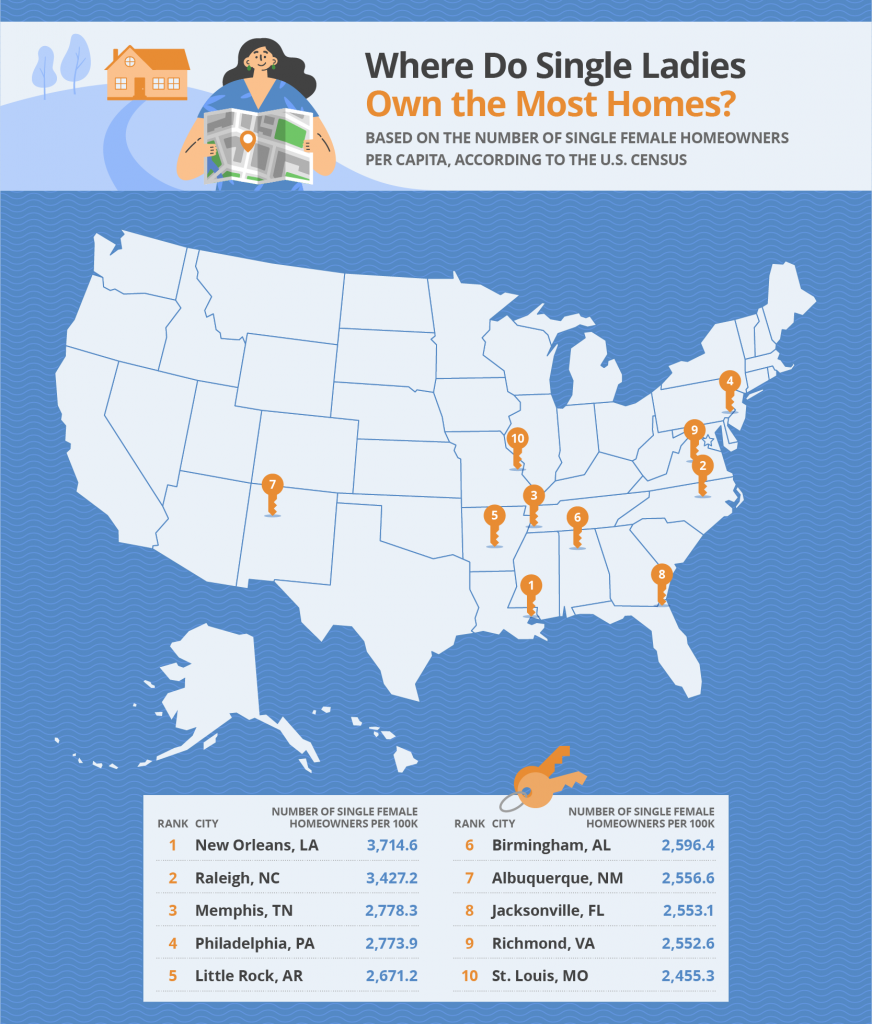

Having ranked the cities based on a combination of homeowning factors, we thought it would be important to point out the cities that have the most female homeowners. After all, a network of female homeowners likely indicates a real estate market that welcomes female buyers regardless of their income level or local home values.

The city with the most single female homeowners is New Orleans, LA, with over 3,700 single female homeowners per 100,000 people. It’s interesting that the city with the highest number of single female homeowners did not make the top 20 cities on the list. Perhaps, this means that the single female homeowners in New Orleans navigate more barriers in terms of affordability and availability.

We also found that even in the top 20 cities, the number of single female homeowners dipped as low as 2,455 per 100,000 homeowners. We could see these numbers grow as single female homeowners take greater control of the market.

Full Data

That wraps up our ranking of the best U.S. cities for single lady homeowners! Interested in diving deeper into the numbers for the top 20 cities, or wanting to see how your city stacks up if it’s not listed within the above maps?

We’ve compiled our full data study for all 50 U.S. cities analyzed into this interactive data table. Search for the city you call home or click on the heading of each column to sort by that category!

Methodology

To rank the best cities for single lady homeownership, we looked at nine ranking factors. We assigned weights to each factor based on their significance to a single lady homeowner. Lastly, we calculated the sum of the nine weighted factors, which gave us an overall city score for each city. The highest possible city score was 50.

The factors are listed below with their respective weights and source data:

Number of Singles Per Capita

Weight: 1.5

Source: U.S. Census

Number of Single, Female-Owned Homes Per Capita

Weight: 1.5

Source: U.S. Census

Median Home Value

Weight: 1.5

Source: U.S. Census

Median Annual Income for Females

Weight: 1.5

Source: U.S. Census

Median Real Estate Property Taxes

Weight: 1.0

Source: City-data.com

Average Homeowners Insurance Rate

Weight: 1.0

Source:Insurance.com

Cost of Living Index

Weight: 1.0

Source: City-data.com

Unemployment Rate

Weight: 0.5

Source: City-data.com

Google Trends Search Volume of “Best Dating Apps”

Weight: 0.5

Source: Google Trends

For the average homeowner’s insurance rate factor, we collected the average rate by city for $300,000 dwelling coverage with $1,000 deductible and $300,000 liability coverage.

We collected Google Trends search volume of the search term “best dating apps” by the metro area over the past 12 months to gauge search interest of online dating for each city within our ranking.